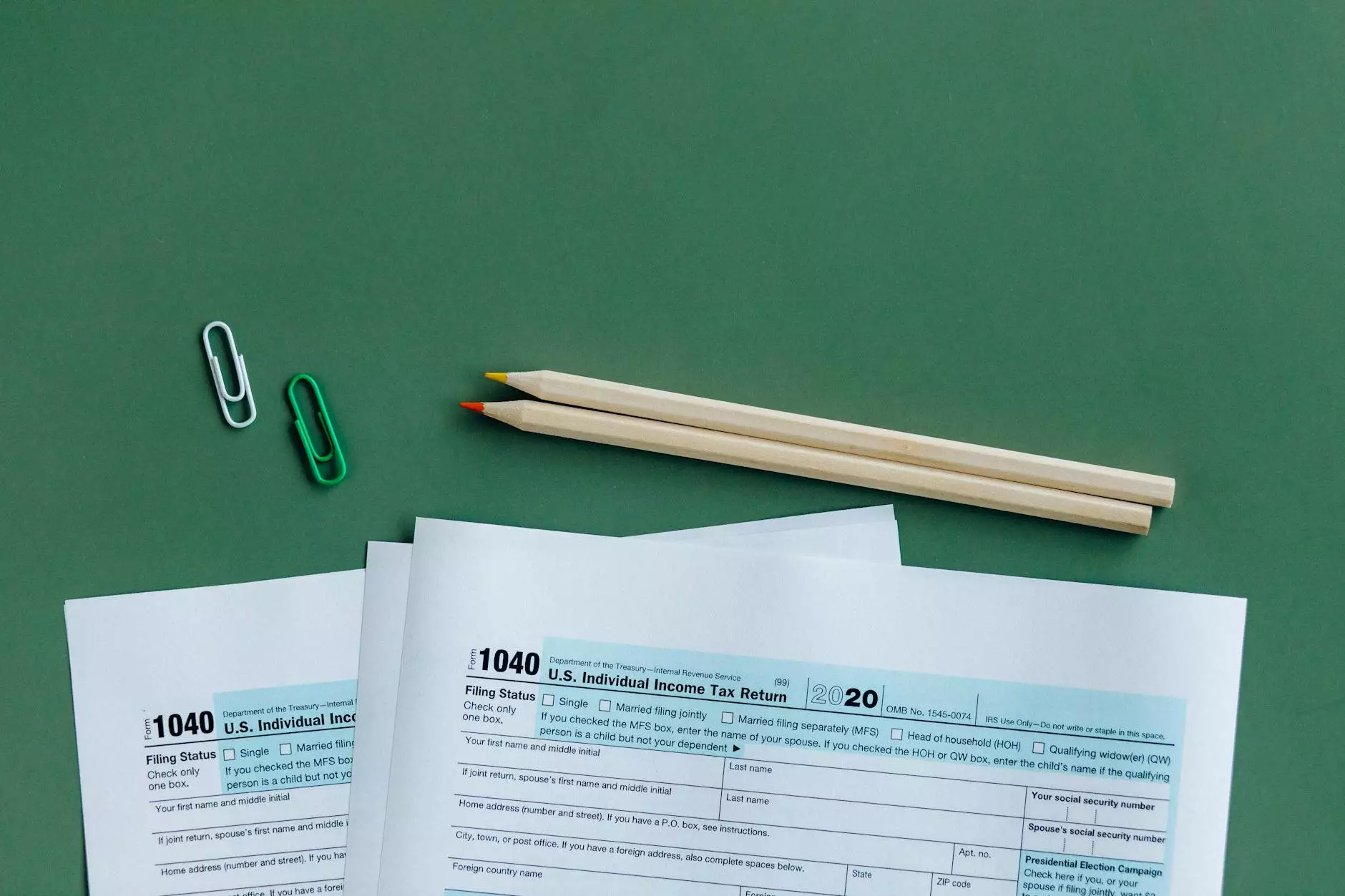

The Essential Role of a Tax Law Attorney in Today’s Business Landscape

In the ever-evolving realm of business, where the complexity of regulations and tax laws can often feel overwhelming, the guidance of a tax law attorney becomes indispensable. Business owners and managers must navigate the intricate network of federal, state, and local tax laws, making informed legal decisions crucial to the success and longevity of their enterprises. This article delves into the significant contributions a tax law attorney makes in fostering business growth, ensuring compliance, and mitigating risk.

Understanding Tax Law: A Business Imperative

The world of tax law is intricate, governed by codes and regulations that can vary significantly from one jurisdiction to another. For businesses, understanding these laws is not simply a matter of compliance; it's a fundamental component of strategic planning. Ignorance or misinterpretation of tax laws can lead to severe financial consequences, including hefty fines and increased scrutiny from tax authorities.

Key Responsibilities of a Tax Law Attorney

A tax law attorney specializes in the nuanced environment of tax codes. Their primary responsibilities include:

- Providing Legal Advice: They offer expertise on a wide array of tax-related issues, advising businesses on how to structure their operations, contracts, and transactions to achieve optimal tax outcomes.

- Ensuring Compliance: Tax laws are dynamic. A skilled tax law attorney keeps abreast of changes in tax legislation, ensuring that a business remains compliant and avoids unnecessary penalties.

- Tax Planning: Strategic tax planning is essential for maximizing profits. Attorneys develop tailored tax strategies that align with a business's specific goals and needs.

- Representation in Disputes: If a business faces disputes with tax authorities, a tax law attorney represents their interests, negotiating on their behalf and striving for favorable resolutions.

The Importance of Tax Planning

Tax planning is a proactive strategy that every business should adopt. With the right tax law attorney, businesses can identify legitimate avenues for tax savings and ensure all financial practices are in line with the law. This planning may include:

- Identifying Deductions: Businesses often qualify for various deductions that can significantly reduce their tax burden, such as deductions for business expenses, depreciation, and credits for hiring practices.

- Structuring Transactions: The way a business structures its transactions can influence its tax rates. Tax attorneys can provide guidance on whether a transaction should be treated as income, capital gains, or another category, optimizing tax liabilities.

- International Tax Considerations: For businesses operating globally, understanding international tax agreements and regulations is crucial. A tax law attorney navigates these complexities to ensure compliance and mitigate risks.

Common Tax Issues Faced by Businesses

Businesses often encounter various tax issues, each requiring a nuanced approach. Here are some common challenges:

- IRS Audits: Businesses may be subjected to audits by the IRS or state tax agencies. Having a tax law attorney on hand can help prepare for and navigate these audits effectively.

- Tax Liabilities: Mismanagement of tax liabilities can lead to outstanding debts that may threaten a business's viability. Tax attorneys develop strategies for resolving these debts and avoiding further financial distress.

- Employee Classification: Misclassification of employees versus independent contractors can lead to significant penalties. Tax attorneys help ensure that businesses classify their workers correctly, in compliance with current laws.

How a Tax Law Attorney Enhances Business Operations

Engaging a tax law attorney enhances a business's operations in myriad ways, including:

- Reducing Tax Liabilities: Effective tax planning can lead to lower tax liabilities, freeing up capital for other business investments.

- Mitigating Risks: By ensuring compliance with tax laws, businesses can avoid audits, penalties, and reputational damage.

- Increasing Efficiency: With a dedicated attorney handling tax issues, business owners and managers can focus on core operational responsibilities without distraction.

Choosing the Right Tax Law Attorney

Selecting an appropriate tax law attorney for your business can profoundly impact your financial health. Consider the following factors:

- Experience: Look for attorneys with a proven track record in handling cases similar to yours. Their experience with specific industries can provide invaluable insights and strategies.

- Reputation: Research potential attorneys, read reviews, and ask for referrals. A reputable attorney will have positive feedback from past clients.

- Communication Skills: The ability to explain complex tax laws in understandable terms is crucial. A good attorney should communicate effectively and be available for questions and consultations.

Conclusion

In conclusion, the role of a tax law attorney is vital in navigating the complex world of business taxation. Their expertise not only ensures compliance but also aids in strategic planning that can significantly reduce tax burdens. By investing in a qualified tax law attorney, businesses can enhance their operational efficiency, maximize profitability, and safeguard their future against potential disputes. In the competitive landscape of business, having a trusted advisor in tax law is not just beneficial; it is essential for long-term success.

For more information about our services, visit us at kesikli.com.